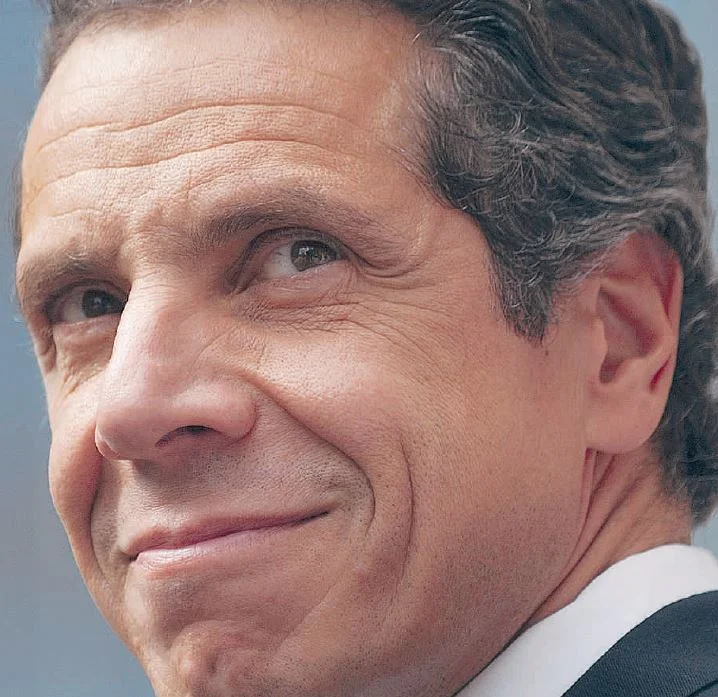

As Cuomo Takes Office, Tough Calls Await

When Andrew Cuomo takes office as governor Jan. 1, he immediately will confront a huge state budget deficit - more than $9 billion for 2011-2012, according to estimates. In the coming weeks, Newsday will examine the three biggest areas of spending - Medicaid, school aid and fringe benefits for public employees - that experts say he'll have to tackle to be successful.

His father liked to say that you campaign in poetry and govern in prose. But Andrew Cuomo skipped the pretty phrases in this mad-as-hell year as he crisscrossed the Empire State seeking to lead a government he called disreputable, discredited and a "national disgrace." New York State can't spend what it doesn't have, he warned voters. Prepare to tighten your belts.

A budget gap of $9 billion or more will greet Cuomo in January - amounting to almost one-fifth of the general fund. That deficit is a hole left by soaring spending and the end of federal stimulus aid that patched New York's way through the first two years of the worst economic downturn since the Great Depression.

What's called for, Cuomo argued, is a fundamental overhaul and paring of government structures that have proliferated unchecked for too long: "New York has no economic future as the highest-taxed state in the nation - period," he repeated often on the stump.

Cuomo's words amount to a call for a radical shift away from the liberal governing tradition of New York, whose residents have borne the nation's highest state and local taxes for most of the last 35 years.

The national avatar of that tradition was Mario Cuomo, who had to close a $1.8-billion deficit - about a tenth of his budget - amid high unemployment when he took office in 1983. The elder Cuomo trimmed 9,000 jobs in his first year, according to news accounts, but the downstate economy, which largely had shifted from manufacturing to services, finance and tourism, was quick to rebound.

This time, there's less hope of a bounce for New York, according to many experts. It has lost 10 congressional seats and the same share of national clout since then, and led the nation in migration of residents to other states. Almost two-thirds of the manufacturing jobs of Mario Cuomo's day are gone, while government pay and benefits increasingly top what the private sector offers. And the financial industry that brought New York roaring back in the 1980s won't be what it was, said Elizabeth Lynam of the nonpartisan Citizens Budget Commission: "The jobs are just starting to be shed. Now they are really going to have to start restructuring their operations."

And so Andrew Cuomo says New York must do the same for its leading areas of expense.

MEDICAID

This sprawling array of services for children, indigent adults, the disabled and frail elderly now covers almost one fourth of the state's population. New York's program is not only generous, it costs twice as much, per capita, as the national average. Many forget that when $11.1 billion in stimulus funding was poured into New York's Medicaid program, it wasn't really aimed at Medicaid per se. But, like a transfusion into a hemorrhaging patient, that program offered the swiftest means to stabilize the overall budget by reducing the state's share of the cost of the program.

Trouble is, Medicaid costs have continued to skyrocket, while more than a million people have lost their employer-sponsored health care, landing many onto its rolls. So Medicaid, which cost New York $15 billion before the recession, would total $21 billion next year without cuts. Cuomo wants a "redesign" negotiated by Medicaid's major players that would eliminate gross inefficiencies. "We need a fundamental restructuring of Medicaid that looks to achieve long-term efficiencies and focuses on services that actually improve the health outcomes of New Yorkers," he said in his main policy book.

Already, informal talks among some of the key players have begun.

SCHOOL AID

The federal stimulus program also provided a $2.5-billion patch to school aid funding to keep teachers employed through the worst of the recession; that aid runs out next year. At the same time, Cuomo has thrown his support behind a property tax cap - popular with voters but troubling to leaders of public-employee unions, who worry about reduced funding for government - that would make it harder for school districts to raise money locally. But the state is also under a court order to steer more state aid to New York City schools, Cuomo reminded Newsday last month.

"It's a question of balancing needs," he said, while also saying that he had found plenty of "waste and fraud" in the system, like the double-dipping Malverne superintendent who brought home $500,000.

Of course, that was before Election Day, when Republicans appeared to have renewed their lock on Long Island's Senate delegation and the Senate leadership, potentially shifting the balance of power on school aid negotiations.

"With a projected $9-billion deficit in the upcoming fiscal year, there are difficult decisions to be made to ensure the budget is balanced," said Scott Reif, spokesman for Senate GOP leader Dean Skelos, of Rockville Centre. "However, with Republicans leading the State Senate, Long Island will once again have a strong voice in Albany working to protect its schools and its taxpayers."

FRINGE BENEFITS

Health benefits for life and a guaranteed pension have always been key to the allure of the civil service, but those costly perks are under intensifying scrutiny.

Over the past 10 years, New York's pension payouts to public retirees have doubled, lifted by cost-of-living increases and a long string of other benefit sweeteners lawmakers approved over the years. In Wall Street's boom times, flush pension funds masked the perks' true costs, but the recession has forced a reckoning. Cuomo is calling for a new pension tier that would curtail pension padding practices he highlighted as attorney general.

Also, new accounting rules have bared the rapidly rising long-term price of health coverage governments provide to public employees who retire before they are old enough for Medicare. The tab for covering current and retired state workers is now estimated at $56 billion over the next 30 years. Just what share of premiums employees must pay is the next battleground.

Cuomo has made his position plain: "No new taxes, no new taxes, no new taxes," he said in Manhattan recently - though he has not ruled out controversial revenue streams like the tax on sugary soda. Encouraged by his tone, business leaders are raising money to counter the expected media blitz from public-sector unions once these issues heat up in the legislature.

But some liberals say the real problem is that lawmakers were too quick to cut taxes when times were good. "I don't think our public pensions are going to bankrupt New York," said James Parrott, chief economist of the liberal-leaning Fiscal Policy Institute.

New York's relatively high taxes pay for the dense urban infrastructure supporting the economic powerhouse of New York City, he said.

But Cuomo points to other statistics that show relatively poor health and education outcomes despite record spending.

Having put out eight volumes of policy during the campaign without ever spelling out what he would cut, Cuomo has said he would rather see the stakeholders work out those details themselves. Pausing after a speech near Buffalo last month, he suggested his leadership should be measured much more simply - by whether he manages to balance the budget on time and without a tax increase.

"Hope springs eternal," he said.

FALLING OFF A BUDGET CLIFF

Most federal stimulus aid for New York expires in 2011. So does a state income tax surcharge on high earners. Put those together with rising costs and the result is: Red ink.

PROJECTE BUDGET GAP IN:

2011-2012 2012-2013 2013-2014

$9B* $14.6B $17.2B

*Could become about $9.3 billion if lawmakers don't close this year's deficit.

SOURCE: DIVISION OF THE BUDGET

TWO ERAS, TWO GOVERNORS

MARIO CUOMO

Then - 1983

"This state has always led the way in demonstrating government's best uses . . . For more than 50 years, without dramatic deviation for whatever party happened to be in power, New York has proven that government can be a positive force for good."

"For all our present travail - the deficits, the stagnant economy, the hordes of homeless, unemployed, and victimized, the loss of spirit and belief - for all of this, I believe we are wise enough to address our deficits without taxing ourselves into bankruptcy . . . "

"Of course, we should have only the government we need. But we must insist on all the government we need."

ANDREW CUOMO

Now - 2010

"The New York State government was at one time a national model. Now it's a national disgrace. The corruption in Albany could make Boss Tweed blush."

"There is no future for the state of New York economically if we're the highest-taxed state in the nation - period!"

"The simple truth is that New York's state and local governments have become too big, too expensive and too ineffective."